Claire Snyder-Hall’s comments at “Delaware’s Keys to a Prosperous Middle Class Future,” a panel discussion sponsored by Delaware Americans for Democratic Action (6/7/15)

Good evening. I am so happy to be a part of this panel. In my day job I serve as program director for Common Cause Delaware, a non-partisan organization that wants to get big money out of politics. We are increasingly concerned about the impact of economic inequality on democratic self government. However, because my topic tonight – the need for a tax on concentrated wealth – is not specifically within the Common Cause purview, I’m speaking tonight as an active member of Delaware Americans for Democratic Action, rather than wearing my Common Cause hat.

Good evening. I am so happy to be a part of this panel. In my day job I serve as program director for Common Cause Delaware, a non-partisan organization that wants to get big money out of politics. We are increasingly concerned about the impact of economic inequality on democratic self government. However, because my topic tonight – the need for a tax on concentrated wealth – is not specifically within the Common Cause purview, I’m speaking tonight as an active member of Delaware Americans for Democratic Action, rather than wearing my Common Cause hat.

If we want to reconstitute a prosperous middle class in this country, we need to increase taxes on concentrated wealth, because it was the lowering of the income tax on top earners that allowed for the emergence of the 1% in this country. That is to say, contrary to what some people want you to believe, the 1% did not emerge because of inevitable changes in the global economy. The 1% emerged because of changes in the tax code, specifically “the very large decrease in the top marginal tax rate … [that was implemented] after 1980.” From 1932-1980, the top marginal tax rate in the US averaged 81% (Piketty, 507). When Reagan lowered that top rate to 28%, that gave CEOs and Wall Street fat cats an incentive to lobby for extremely high salaries, which they successfully acquired (Piketty, 510). And that, combined with deliberate attacks on unions that lowered wages, has, over time, decimated the middle class in this country.

And if we think the 1%, with their outsized influence on elections and ability to influence policy to their benefit, are threatening now, just wait until their children and grandchildren inherit their accumulated wealth. Then we will really see the emergence of a new aristocracy, a powerful oligarchy – which is exactly what our founders feared.” As Supreme Court Justice Brandeis famously put it, “We can either have democracy in this country or we can have great wealth concentrated in the hands of a few, but we can‘t have both.”

And if we think the 1%, with their outsized influence on elections and ability to influence policy to their benefit, are threatening now, just wait until their children and grandchildren inherit their accumulated wealth. Then we will really see the emergence of a new aristocracy, a powerful oligarchy – which is exactly what our founders feared.” As Supreme Court Justice Brandeis famously put it, “We can either have democracy in this country or we can have great wealth concentrated in the hands of a few, but we can‘t have both.”

In the post war period, we had a very progressive system of taxation in the United states, and consequently, we saw decades of widely shared prosperity and a thriving middle class. We built highways and bridges, the greatest universities in the world, a social safety net to keep seniors out of poverty and lift up the most desperate among us.

It’s important to note, however, that we implemented this very progressive income tax not only to enable the emergence of widespread prosperity, but also to protect democratic self government, by preventing the emergence of wealthy elites, who could use their power to aggrandize themselves at the expense of the rest of us – today’s 99%. Democratic self-government requires a strong middle class as its foundation, and huge disparities between rich and poor make democratic self-government impossible – a point made by Aristotle way back in the day.

It’s important to note, however, that we implemented this very progressive income tax not only to enable the emergence of widespread prosperity, but also to protect democratic self government, by preventing the emergence of wealthy elites, who could use their power to aggrandize themselves at the expense of the rest of us – today’s 99%. Democratic self-government requires a strong middle class as its foundation, and huge disparities between rich and poor make democratic self-government impossible – a point made by Aristotle way back in the day.

So that is the overall context we face as a country, but what does that all mean for DE?

Right now in DE, we face a budget shortfall of $83 million at a time when we have an increasing need for government services – to educate our young people effectively, to maintain adequate infrastructure, to care for our aging population, to expand our hospitals, to help people suffering from mental illness or drug addiction, to clean up our environment, etc. etc.

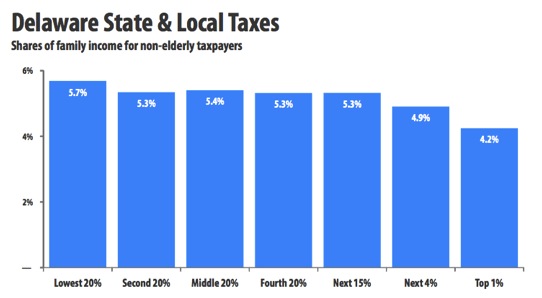

Delaware needs more revenue. It goes without saying that nobody wants to pay more taxes, but we need to figure out a fair and sustainable way to pay for necessary services and infrastructure. We can’t keep counting on creative book keeping, casino revenues, and other tricks to balance the budget – and we certainly don’t want to implement a regressive sales tax that would hit poor and working class people harder than anyone.

The fairest way to raise revenue is to increase the taxes of those who can most afford it. In DE, the 1% earn on average $863,734 – and that reflects a 15% increase over the last 6 years – yet they have the same marginal tax rate as people making $60,000 who have seen their income decrease by 1.6%. That does not make sense. Those with concentrated wealth need to pay their fair share.

The fairest way to raise revenue is to increase the taxes of those who can most afford it. In DE, the 1% earn on average $863,734 – and that reflects a 15% increase over the last 6 years – yet they have the same marginal tax rate as people making $60,000 who have seen their income decrease by 1.6%. That does not make sense. Those with concentrated wealth need to pay their fair share.

Recently Rep. John Kowalko and others have proposed raising taxes on the wealthiest Delawareans. Consider this. People making $60,000 and above now have a marginal tax rate of 6.6%. If we raised the marginal tax rate on people earning over $250,000 by a mere 1%, we would generate $46.7 million in revenue. If we raised taxes on those making $125,000 and above, we would generate $71.7 million. I know that $125,000 a year does not sound like a lot of money to some people, but consider that the average income in DE is only $46,686.

Before concluding, I also want to briefly mention another really important tax change we should make that would help rebuild the middle class, and that is to make the EITC refundable. Right now, DE is one of only 4 states [Maine, OH, VA], in which the EITC is not fully refundable. Making it refundable would be a great companion bill to raising marginal tax rates.

In conclusion, if we need more money in the budget, which we do, the fairest way is to increase taxes on concentrated wealth, including that accumulated by Delaware’s highest earners. That makes the most sense fiscally but it also makes the most sense if we want to protect democratic self-government. From the founding, we have had a system of government in this country that puts constraints on concentrated political power – with the separation of powers, checks and balances, and federalism. The challenge for us now is to also put constraints on large concentrations of economic power and step one is creating a fair, and progressive system of taxation in DE and the United States. Thank you.